You all must have read about the immense scope of markets in economics textbooks. But what does market structure look like in the real world? Market structure can be categorized based on the competition levels and the nature of markets. Let’s look into the details of market structure in this article.

What Is Market Structure?

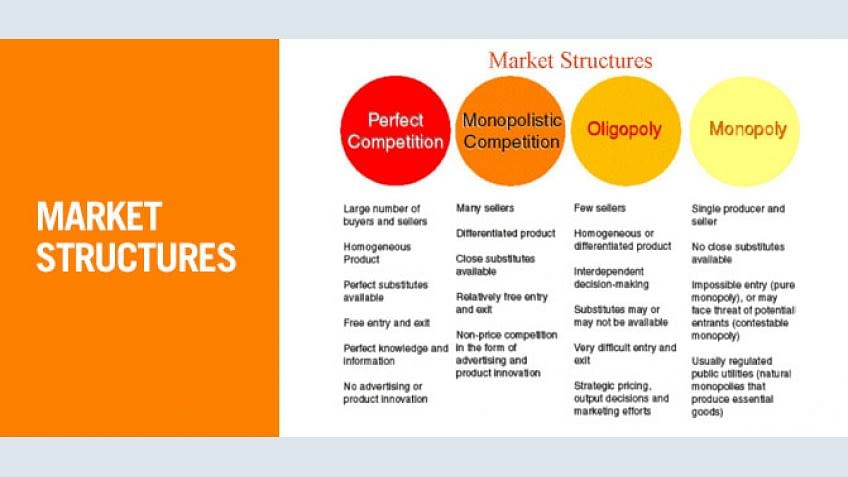

Market structure refers to the way that various industries are classified and differentiated in accordance with their degree and nature of competition for products and services. It consists of four types: perfect competition, oligopolistic markets, monopolistic markets, and monopolistic competition.

Types of Market Structures

According to economic theory, market structure describes how firms are differentiated and categorized by the types of products they sell and how those items influence their operations. A market structure helps us to understand what differentiates markets from one another.

In economics, market structure is the number of firms producing identical products which are homogeneous. The types of market structures include the following:

- Monopolistic competition, also called competitive market, where there is a large number of firms, each having a small proportion of the market share and slightly differentiated products.

- Oligopoly, in which a market is by a small number of firms that together control the majority of the market share.

- Duopoly, a special case of an oligopoly with two firms.

- Monopsony, when there is only one buyer in a market.

- Oligopsony, a market in which many sellers can be present but meet only a few buyers.

- Monopoly, in which there is only one provider of a product or service.

- Natural monopoly, a monopoly in which economies of scale cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms.

- Perfect competition, a theoretical market structure that features no barriers to entry, an unlimited number of producers and consumers, and a perfectly elastic demand curve.

The imperfectly competitive structure is quite identical to the realistic market conditions where some monopolistic competitors, monopolists, oligopolists and duopolists exist and dominate the market conditions. The elements of Market Structure include the number and size distribution of firms, entry conditions, and the extent of differentiation.

These somewhat abstract concerns tend to determine some but not all details of a specific concrete market system where buyers and sellers actually meet and commit to trade. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller’s financial need to cover its costs. In other words, competition can align the seller’s interests with the buyer’s interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control of market power and an asymmetry between the government and the operator with respect to objectives and information: (a) subjecting the operator to competitive pressures, (b) gathering information on the operator and the market, and (c) applying incentive regulation.

Monopolistic Markets Characteristics

Monopolistically competitive markets have the following characteristics:

- There are many producers and many consumers in the market, and no business has total control over the market price.

- Consumers perceive that there are non-price differences among the competitors' products.

- There are few barriers to entry and exit.

- Producers have a degree of control over price.

The long-run characteristics of a monopolistically competitive market are almost the same as a perfectly competitive market. Two differences between the two are that monopolistic competition produces heterogeneous products and that monopolistic competition involves a great deal of non-price competition, which is based on subtle product differentiation. A firm making profits in the short run will nonetheless only break even in the long run because demand will decrease and average total cost will increase. This means in the long run, a monopolistically competitive firm will make zero economic profit. This illustrates the amount of influence the firm has over the market; because of brand loyalty, it can raise its prices without losing all of its customers. This means that an individual firm's demand curve is downward sloping, in contrast to perfect competition, which has a perfectly elastic demand schedule.

Oligopoly Characteristics

- Profit maximization conditions: An oligopoly maximizes profits by producing where marginal revenue equals marginal costs.

- Ability to set price: Oligopolies are price setters rather than price takers.

- Entry and exit: Barriers to entry are high. The most important barriers are economies of scale, patents, access to expensive and complex technology, and strategic actions by incumbent firms designed to discourage or destroy nascent firms. Additional sources of barriers to entry often result from government regulation favoring existing firms making it difficult for new firms to enter the market.

- Number of firms: "Few" – a "handful" of sellers. There are so few firms that the actions of one firm can influence the actions of the other firms.

- Long run profits: Oligopolies can retain long run abnormal profits. High barriers of entry prevent sideline firms from entering the market to capture excess profits.

- Product differentiation: Product may be homogeneous (steel) or differentiated (automobiles).

- Perfect knowledge: Assumptions about perfect knowledge vary but the knowledge of various economic factors can be generally described as selective. Oligopolies have perfect knowledge of their own cost and demand functions but their inter-firm information may be incomplete. Buyers have only imperfect knowledge as to price, cost and product quality.

- Interdependence: The distinctive feature of an oligopoly is interdependence. Oligopolies are typically composed of a few large firms. Each firm is so large that its actions affect market conditions. Therefore the competing firms will be aware of a firm's market actions and will respond appropriately. This means that in contemplating a market action, a firm must take into consideration the possible reactions of all competing firms and the firm's countermoves. It is very much like a game of chess or pool in which a player must anticipate a whole sequence of moves and countermoves in determining how to achieve his or her objectives. For example, an oligopoly considering a price reduction may wish to estimate the likelihood that competing firms would also lower their prices and possibly trigger a ruinous price war. Or if the firm is considering a price increase, it may want to know whether other firms will also increase prices or hold existing prices constant. This high degree of interdependence and need to be aware of what other firms are doing or might do is to be contrasted with lack of interdependence in other market structures. In a perfectly competitive (PC) market there is zero interdependence because no firm is large enough to affect market price. All firms in a PC market are price takers, as current market selling price can be followed predictably to maximize short-term profits. In a monopoly, there are no competitors to be concerned about. In a monopolistically-competitive market, each firm's effects on market conditions is so negligible as to be safely ignored by competitors.

- Non-Price Competition: Oligopolies tend to compete on terms other than price. Loyalty schemes, advertisement, and product differentiation are all examples of non-price competition

Perfectly Competitive Market Characteristics

- Infinite buyers and sellers – An infinite number of consumers with the willingness and ability to buy the product at a certain price, and infinite producers with the willingness and ability to supply the product at a certain price.

- Zero entry and exit barriers – A lack of entry and exit barriers makes it extremely easy to enter or exit a perfectly competitive market.

- Perfect factor mobility – In the long run factors of production are perfectly mobile, allowing free long term adjustments to changing market conditions.

- Perfect information - All consumers and producers are assumed to have perfect knowledge of price, utility, quality and production methods of products.

- Zero transaction costs - Buyers and sellers do not incur costs in making an exchange of goods in a perfectly competitive market.

- Profit maximizing - Firms are assumed to sell where marginal costs meet marginal revenue, where the most profit is generated.

- Homogenous products - The qualities and characteristics of a market good or service do not vary between different suppliers.

- Non-increasing returns to scale - The lack of increasing returns to scale (or economies of scale) ensures that there will always be a sufficient number of firms in the industry.

- Property rights - Well defined property rights determine what may be sold, as well as what rights are conferred on the buyer.

Final Thought

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly and pure monopoly. The main criteria by which one can distinguish between different market structures are the number and size of producers and consumers in the market, the type of goods and services being traded and the degree to which information can flow freely.

If you have good ideas about different markets and their specific characteristics, making a career in Marketing will be a good option for you. Become a Digital Marketing expert with the help of the professional certificate, offered by IMT Ghaziabad in collaboration with Simplilearn. Get a holistic understanding of the digital marketing field by exploring topics like SEO, Social Media, PPC, Web Analytics, and Marketing Analytics. Sign-up today and start learning!